Author: Rohan Desai, Commercial Real Estate Analyst Date: October 13, 2025

A Guide to Buying a Commercial Property for Investment in Pune

For investors seeking to build substantial wealth, the conversation inevitably turns to real estate. While residential properties are a common entry point, the truly strategic move for generating significant, stable returns is to acquire a commercial property for investment. This asset class is specifically designed for business use and, as such, offers superior financial advantages. For those looking to capitalize on this opportunity, Pune, with its dynamic economy, has become a premier destination for purchasing a commercial property for investment.

This comprehensive guide will detail why a commercial property for investment is a superior choice, how to analyze returns, and why Pune is the ideal market for your next acquisition.

Table of Contents

- Why a Commercial Property for Investment is a Superior Choice

- Analyzing the Returns: How to Calculate Rental Yield

- Is Pune the Best Place to Invest in Property Right Now?

- A Guide for Global Investors: Real Estate Investment in Pune

- Making a Smart Choice in Commercial Real Estate

Why a Commercial Property for Investment is a Superior Choice

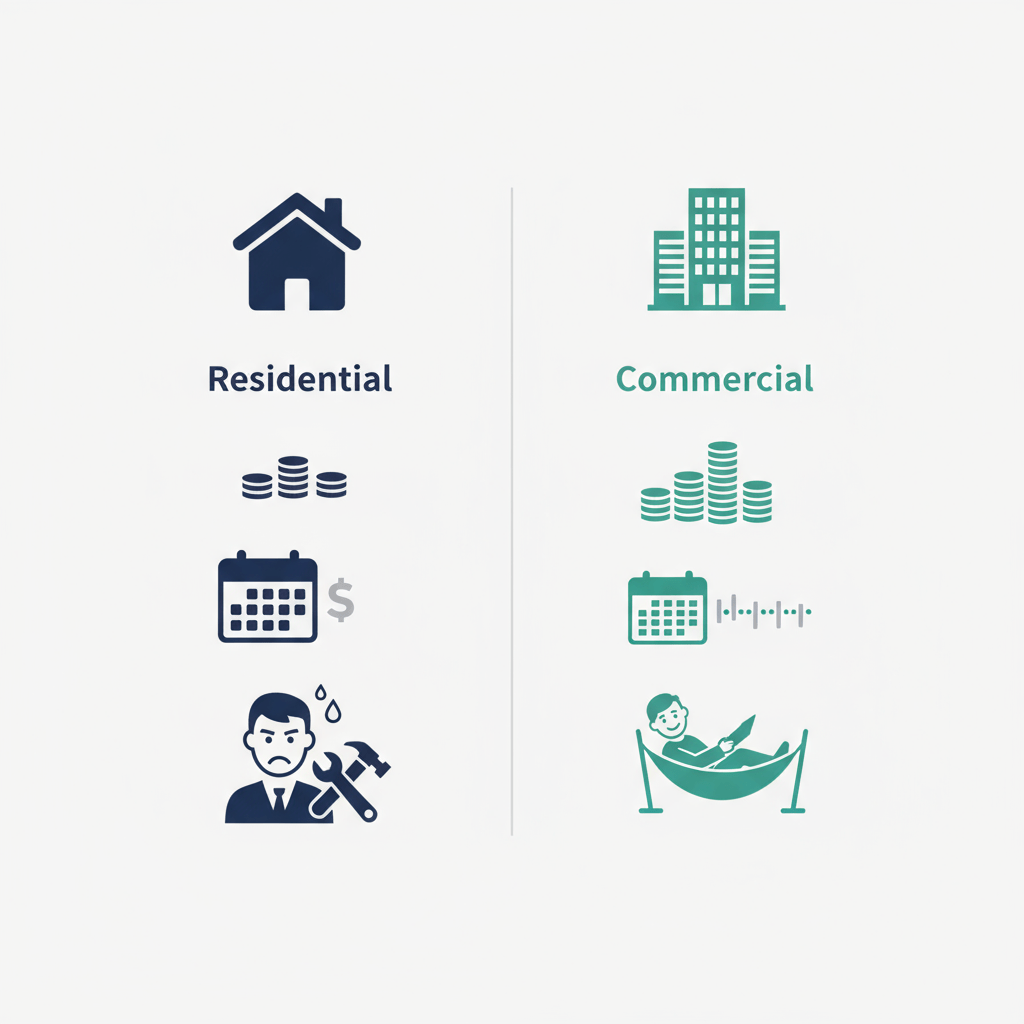

When investors evaluate their options, a commercial property for investment consistently stands out for its robust performance and structural benefits. Unlike residential units, these properties, which include office spaces, retail outlets, and specialized facilities, are leased by businesses, creating a more professional and profitable ecosystem for the owner.

The core advantages of choosing a commercial property for investment include:

- Higher Rental Yields: The primary draw is a superior rental yield. Commercial assets almost always generate a higher return than residential ones.

- Long-Term Leases: Businesses seek stability. This translates to long-term lease agreements, often spanning 5, 10, or even 15 years, ensuring a predictable and uninterrupted income stream for the investor.

- Professional Tenants: Dealing with a corporate tenant is a fundamentally different experience. It means timely payments, professional communication, and a vested interest in maintaining the property’s condition.

Understanding the Power of a Pre-Leased Property

Within the commercial sector, the most secure and sought-after asset is a pre leased property. When you buy a pre leased property, you are acquiring an asset that comes with a tenant and a long-term rental contract already in place. This is the pinnacle of a de-risked commercial property for investment. The search for a tenant—the biggest hurdle for most property owners—is completely eliminated. Your investment begins generating income from day one, making it a truly turnkey solution. A pre leased property is the fastest way to see returns on your commercial property for investment.

Analyzing the Returns: How to Calculate Rental Yield

For any commercial property for investment, the most critical metric is its rental yield. This simple percentage tells you exactly how hard your asset is working for you.

The formula is: Rental Yield = (Annual Rental Income / Total Property Cost) x 100

Let’s illustrate with a clear example. Imagine a commercial property for investment in Pune is acquired for an all-inclusive cost of ₹75 lakhs. As a pre leased property, it generates a fixed monthly rent of ₹35,000.

- Annual Rental Income: ₹35,000 x 12 = ₹4,20,000

- Total Property Cost: ₹75,00,000

The Rental Yield is: (₹4,20,000 / ₹75,00,000) x 100 = 5.6%

A rental yield of 5.6% is a powerful return, making this commercial property for investment a high-performing asset that easily beats inflation and traditional investment vehicles.

Is Pune the Best Place to Invest in Property Right Now?

The evidence is overwhelming: Pune is unequivocally the best place to invest in property in pune today. The city’s economic foundation is exceptionally strong, creating a fertile ground for commercial activity and, consequently, for investors in commercial property for investment.

- Economic Powerhouse: Pune’s thriving IT, manufacturing, and automotive sectors ensure a constant demand for commercial spaces. This economic stability is crucial for any long-term real estate investment in pune.

- Infrastructure Growth: With massive projects like the Metro and the upcoming Ring Road, Pune’s connectivity is improving daily. This infrastructure boom is a key reason why it’s the best place to invest in property in pune.

- Demographic Dividend: A young, educated workforce fuels economic growth and creates a vibrant market for commercial services.

The Untapped Potential of Niche Commercial Real Estate

While traditional office spaces are a valid option, the smartest investors are targeting niche sectors. A prime example is a facility leased to a senior living operator. This type of asset functions as a high-demand commercial property for investment. Its success is tied to the powerful, non-negotiable demographic trend of an aging population, making it uniquely secure.

Rethinking Commercial Assets: The Case for a 1 BHK Flat in Pune

This leads to an innovative strategy. Can a residential unit like a 1 bhk flat in pune function as a commercial property for investment? The answer is yes—if it’s part of a project entirely leased to a commercial operator. When you purchase a 1 bhk flat in pune within a complex pre-leased to a senior living company, your tenant is the corporation. You get the benefits of a long-term commercial lease, professional management, and high rental yield, all packaged in an affordable, easy-to-sell residential asset.

A Strategic Location: Investment Property Near Bhugaon

The long-term value of your commercial property for investment is tied to its location. An investment property near bhugaon is a masterstroke. Bhugaon is a strategic growth corridor in West Pune, offering the perfect blend of a serene environment and proximity to the Hinjewadi IT hub. For investors, an investment property near bhugaon means securing an asset in an area primed for both rental demand and capital appreciation.

A Guide for Global Investors: Real Estate Investment in Pune

Pune’s remarkable growth is attracting global capital. For NRIs, a real estate investment in pune has never been more accessible, especially when focusing on the commercial sector. The pre-leased model is tailor-made for those looking for a remote real estate investment in Pune.

Because a pre leased property is professionally managed by the corporate tenant, it is the ideal fully managed property for sale Pune. There is no operational involvement required from the owner. This structure makes it the best property for NRIs to invest in Pune, offering a secure, passive income stream without the logistical headaches of overseas ownership. A fully managed property for sale Pune is the key to a successful remote real estate investment in Pune.

Conclusion: Making a Smart Choice in Commercial Real Estate

Choosing to acquire a commercial property for investment is a definitive step towards building a resilient, high-performance portfolio. By prioritizing the pre leased property model, you secure your returns and eliminate risks. By selecting a high-growth market like Pune and identifying a unique commercial property for investment within it, you are not just buying an asset—you are making a strategic decision for long-term financial prosperity.

Check our channel for more properties https://www.youtube.com/@SpaceDecisions

Frequently Asked Questions (FAQs)

1. What is the difference between a commercial and a residential pre-leased property? The key difference is the tenant and lease structure. A commercial property for investment has a business as a tenant on a long-term lease (5+ years). A residential property has an individual tenant. However, a hybrid model where a residential building is leased entirely to a commercial operator offers the best of both worlds.

2. What is a good rental yield for a commercial property for investment in Pune? Investors should target a rental yield of at least 5-6% for a quality commercial property for investment in Pune. This is a significant premium over the 2-3% typically seen in the residential market.

3. Can I get a loan to purchase a small commercial property like a pre-leased 1 BHK? Yes. When a 1 bhk flat in pune is part of a project with a commercial pre-lease structure, banks view it very favorably due to the guaranteed income from a corporate tenant, making financing accessible.

4. Why is Bhugaon considered a good location for real estate investment in Pune? Bhugaon is a strategic growth corridor with proximity to major IT hubs and excellent connectivity. This makes an investment property near bhugaon a prime choice for investors seeking both rental income and capital appreciation.

5. How can an NRI manage a commercial property investment in Pune remotely? The simplest way is by purchasing a fully managed property for sale Pune. The pre-leased model ensures all management is handled by the corporate tenant, making it the perfect hands-off remote real estate investment in Pune.

6. What are the tax benefits of investing in commercial property in India? Investing in a commercial property for investment offers significant tax advantages, including deductions on loan interest and property taxes, which can enhance your net rental yield.

Check here for more details https://codenameroibhugaon.com/